Significant Investor Visa (SIV)

- Investments must be provided by an Australian Financial Services (AFS) licensed manager(s) domiciled in Australia.

- Fund managers must be independent of the applicant and their spouse.

- Investments are permitted through a ‘Fund of Fund’ (FoF) or an Investor Directed Portfolio Service (IDPS) into complying managed fund(s) only.

- Applicant monies may be held in cash for up to 30 days in a FoF or IDPS at the time of first investment by the applicant and during any switching period.

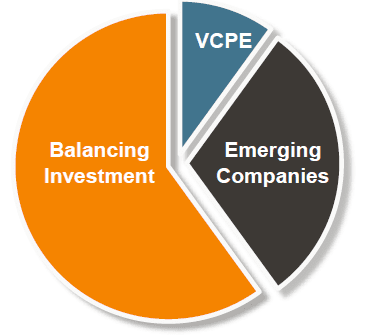

- Complying Investments comprise mandatory investments in Venture Capital and Growth Private Equity Funds (VCPE) and Emerging Companies, and balancing investments in Balancing Investments.

- Investments in VCPE and Emerging Companies may be for higher amounts than the mandated minimums and up to the full amount of Balancing Investment (the balancing investment quanta) if desired.

- Investments must be provided by an Australian Financial Services (AFS) licensed manager(s) domiciled in Australia.

- Fund managers must be independent of the applicant and their spouse.

- Investments are permitted through a ‘Fund of Fund’ (FoF) or an Investor Directed Portfolio Service (IDPS) into complying managed fund(s) only.

- Applicant monies may be held in cash for up to 30 days in a FoF or IDPS at the time of first investment by the applicant and during any switching period.

- Complying Investments comprise mandatory investments in Venture Capital and Growth Private Equity Funds (VCPE) and Emerging Companies, and balancing investments in Balancing Investments.

- Investments in VCPE and Emerging Companies may be for higher amounts than the mandated minimums and up to the full amount of Balancing Investment (the balancing investment quanta) if desired.

Contact

- Level 3, 12 St Georges Terrace, Perth, Western Australia, 6000

- [email protected]

- +618 9328 7525

Brochures

SIV: Venture Capital and Growth Private Equity Funds (VCPE)

Note: Investments into VCPE funds may be for investment terms that are greater than the provisional visa period.

Compliance will consist of a three part test: proof that applicant monies are taken upfront in a specified vehicle; proof that the applicant has entered into a commitment with a VCPE fund(s) within 12 months from the grant of the provisional visa; and proof that investments in a VCPE fund(s) have commenced within four years from the grant of the provisional visa.

- Mandatory investment of at least $500,000 at time of investment in an AusIndustry registered fund(s) (either ESVCLP or VCLP).

- Applicant monies for the full amount of the commitment are to be taken upfront to satisfy issuing a provisional visa and deposited either in a Cash Management Trust (CMT) held in escrow, or an Australian bank account as security for a bank guarantee in favour of a VCPE, to meet capital calls by the VCPE over the investment horizon.

- Applicants will need to enter into a commitment with a VCPE within 12 months from the date they were issued a provisional visa.

- Proceeds from the realisation of investments by the VCPE fund(s) before the provisional visa ends are to be reinvested in complying funds from VCPE, Emerging Companies or Balancing Investment.

SIV: Funds investing in Emerging Companies

- Mandatory investment of at least $1.5 million at time of investment in an eligible fund(s).

- A complying fund must have the following:

- Investment in securities of companies that have a market capitalisation (mkt cap) of less than $500m at the time of first purchase by the fund. Investments are to be ASX listed or Australian unlisted companies, but unlisted are to be no more than 20% of the fund’s net assets. Up to 20% of the fund’s net assets may be in other Australian exchange listed companies.

- Up to 10% of the fund’s net assets may be invested in foreign exchange listed companies. (e.g. New Zealand) with a mkt cap of less than $500m at the time of first purchase by the fund.

- Up to 30% of the fund’s net assets can be in previously held assets whose companies have grown their mkt cap above $500m.

- Must maintain a minimum of 20 investee companies from three months post the fund’s inception date.

- No further purchase can be made to any individual asset that exceeds 10% of the fund’s net assets.

- Cash is to be no more than 20% of a fund’s net assets.

- Derivatives are to be used for risk management purposes only.

- Managed funds (open or close-end) or Listed Investment Companies (LICs) are eligible.

- Fund Managers are to have and maintain a minimum $100m in firm-wide funds under management (FUM) to offer a complying fund(s) to applicants.

SIV: Balancing Investment

Funds invested in:

- Companies, A-REITs, infrastructure trusts including their ordinary equity, preferred equity, convertible bonds or corporate issued floating rate notes listed on an Australian securities exchange.

- Corporate bonds or notes issued by an Australian exchange listed entity (or wholly owned subsidiary of the Australian listed entity) or investment grade rated Australian corporate bonds or notes rated by an AFS licensed debt rating agency.

- Deferred annuities issued by Australian registered life companies but cannot commence paybacks during the provisional visa period.

- Real Property in Australia (subject to 10% limit on residential real estate).

- A complying fund must have the following:

– Cash is to be no more than 20% of a fund’s net assets.

– Derivatives are to be used for risk management purposes only. - Managed funds (open or close-end) or Listed Investment Companies (LICs) are eligible.

- Fund Managers are to have and maintain a minimum $100m in firm-wide FUM to offer a complying fund(s) to applicants.